As a recent college graduate there are moments when I look back at my time at Ball State University and realize that I did truly learn from my mistakes. Now saying someone makes mistakes in college isn’t a shocking statement, but what if you learned that you could have easily taken care of (or even avoided) that mistake if you would have just listened.

I was returning to Ball State University for my junior year of college. My four roommates and I had to come back to school earlier than normal because we were on the soccer team and had pre-season. One of my roommates and I were the first to arrive at our house that we had rented the year before and immediately could tell something was wrong.

We noticed that there was laundry in our washing machine, our kitchenware that had been left at the house had been moved and put into the sink like it needed to be washed and my roommate from Switzerland who did not bring all her clothes home during break noticed that her closet had been rummaged through. Worst of all, we noticed that our television and my roommate’s gaming system had been taken.

Panic began to sink in. We called our landlord who had checked the house the day before and he said he had assumed the mess was from one of us who was visiting during the summer. That’s when we realized that there had been people living in our home sometime during the summer and when they left, they decided to take a few things with them.

After we called the police and reported the incident the next step was getting our stuff back. Because neither I nor any of my roommates had renters insurance (our landlord didn’t require it), we were stuck with accepting the consequences. The TV that we purchased was gone along with my friend’s expensive gaming system and random clothes and other household items.

If we had had renters insurance the result of the incident could have been different. Although insurance was not required, it would have saved us money and time in trying to get our stolen items replaced. This was an expensive lesson to learn.

After that incident, when I moved into my first apartment post-college the first thing I did was purchase a renters insurance policy. Although, at that point my apartment in downtown Indianapolis did require it, I did not mind one bit paying for protection that could help me in the long run.

Are you required to have renters insurance in Indiana?

Renters insurance is not required in the state of Indiana, but some property owners and apartment complexes do require their tenants to purchase a renters insurance policy. It may be tempting to save money if your landlord does not require a policy, but the risk outweighs the cost in many cases.

If you have valuable items in the home or apartment you rent and something happens to them, that renters insurance policy may be able to cover that loss and save you from many headaches.

How to determine if you need renters insurance?

The best way to determine whether or not you need renters insurance in Indiana is by asking the landlord or apartment complex if you are required under their terms to purchase a renters insurance policy. You can also review the terms of your rental contract to determine if renters insurance is required.

Regardless of the requirement learn from my mistake! A renters insurance policy would have covered my lost items, and I wouldn’t have had to pay for replacements directly out of pocket.

Before you say no and move on, know that renters insurance quotes are free online, can help you determine how much coverage you need and give you an estimate of the price you’ll pay for this needed protection. You may be surprised to learn that renters insurance is relatively inexpensive.

What does renters insurance protect me from?

A renters insurance policy could have protected me by covering the replacement cost of some of the items that were stolen from the house that I was renting. The policy could have also protected me from paying out-of-pocket for some of the damage that was done to the home.

There are many more scenarios in which renters insurance can help with legal expenses if someone is injured in your rental unit. Indiana Farm Bureau Insurance insures for direct physical loss to the property described in Coverage C caused by a peril listed below:

Windstorm or hail - This peril does not include loss to the property contained in a building caused by rain, snow, sleet, sand or dust unless the direct force of wind or hail damages the building causing an opening in a roof or wall and the rain, snow, sleet, sand or dust enters through this opening. This peril includes loss to watercraft and their trailers, furnishings, equipment, and outboard engines or motors, only while inside a fully enclosed building

Aircraft, including self-propelled missiles and spacecraft

Smoke, meaning sudden and accidental damage from smoke

Vandalism or malicious mischief

How much is renters insurance a month in Indiana?

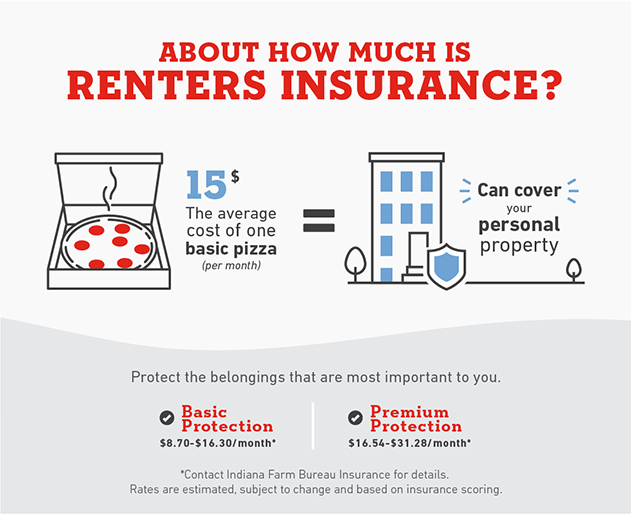

The average cost of renters insurance a month can depend on the type of protection you purchase. Basic protection can fluctuate between $8.70 to $16.30 per month.* Premium protection can be anywhere between $16.54 to $31.28 per month.* So, if you are looking to not break the bank but still want to have coverage, there are cheap renters insurance options out there.

Wondering how much your renters insurance may cost? Check our renters insurance calculator for a quick estimate of how much you may pay for a policy you want.

Factors that affect renters insurance

There are many factors that can affect the price of your renters insurance policy. Here are some of the factors:

What insurance company you purchase the policy from

Your past claims experience if you have had previous renters insurance

The amount and type of coverage you want to purchase

The state in which you live

The size of the home or apartment

The current fire prevention and detection methods available in your home

Security measures that are in place

The deductible you decide to choose for your policy

Discounts that you qualify for - If you bundle your auto and home or auto and renters insurance policies you can save with the Multi-Line Discount. Policyholders can save up to 23% when they bundle certain insurance policies.

Where to get renters insurance

Indiana Farm Bureau Insurance has been serving all Hoosiers for nearly 90 years. It serves Indiana residents in all 92 counties and are known for its quick and stress-free claims experiences and trusted agents getting to know you beyond just your policy number.

Find a local insurance agent near you to help start the process and get you the protection you need for any stage of your life.

*Contact Indiana Farm Bureau Insurance for details. Rates are estimated, subject to change and based on insurance scoring.

Inside Story is for educational and informational

purposes only. Inside Story is compiled from various sources, which may or may

not be affiliated with our family of companies, and may include the assistance

of artificial intelligence. While we strive to provide accurate and reliable

content, we make no warranties or guarantees about its completeness, accuracy,

or reliability, and are not responsible for the content of any third-party

sources or websites referenced herein. The inclusion of any content does not

establish a business relationship or constitute our endorsement, approval, or

recommendation of any third party. Testimonials and examples provided are for

illustrative purposes only and do not guarantee future or similar results or

outcomes, and may not consider individual circumstances, goals, needs, or

objectives. Inside Story does not provide legal, tax, or accounting advice. For

individual guidance, please consult a qualified professional in the appropriate

field.

Coverages

subject to policy terms, conditions, and exclusions. Subject to underwriting

review and approval.