Would you like more information on how much life insurance you need, or which policy is right for you and your needs? Try our life insurance calculator to help calculate how much coverage you need for yourself and your loved ones.

Why should I purchase a life insurance policy now?

When deciding the best time to purchase a life insurance policy, you will want to keep in mind the premium. The earlier you purchase a life insurance policy, the less expensive the premium can be. A life insurance policy premium can increase as you age, so securing coverage when you are younger and healthier is always a good decision.

But determining the price of a life insurance policy it is not all about the premium. A life insurance policy can also help your loved ones in the event that you unexpectedly pass away. If you purchase life insurance and make your partner, significant other, family member or another person your beneficiary, they will receive the life insurance benefits. Although, the loss will be extremely hard, the money that you beneficiaries could receive may help with funeral and burial costs, living expenses, debt, unpaid loans or other expenses that may have accumulated over time.

How much does it cost to protect your loved ones?

The cost of life insurance can vary based many things. The price can change based on the age you purchase the life insurance policy, the state you live, whether you are male or female, whether you use tobacco, and many other factors that are included in creating a customized life insurance policy.

Talk to a local agent to find out more about what kind of coverages you need and get a free customized insurance quote. This information will help you determine what is best for you. You can also check out our life insurance calculator to help determine how much coverage you need.

Now you must be wondering, where to buy the life insurance policy

You have the knowledge and now you know why you need to purchase life insurance young. If you think it is too early or too late to purchase a life insurance policy, you are mistaken. There is never a wrong time to protect your future, but where do you purchase a life insurance policy from?

Indiana Farm Bureau Insurance has a policy that will fit the needs of you and your loved ones. Simply fill out a quote request and a trusted agent will reach out to you. By filling out the request, you will be one step closer to a free life insurance quote from us. This quote will help you determine which policy is the best fit for you.

Would you prefer to speak with an agent before you receive a free life insurance quote? Find your local insurance agent who will help walk you through the process of finding the right coverage.

Frequently asked questions

When it comes to insurance there is usually a lot of information that comes at you all at once. Here are common frequently asked questions when it comes to life insurance:

Who receives my life insurance benefits if I am single?

When you purchase a life insurance policy as a single person, you still have the choice to choose your beneficiary. It could be a parent, other relative, partner or a friend. The individual that you choose to be your beneficiary will be the one to receive your life insurance benefits if the unexpected occurs. The life insurance proceeds are income tax free to the beneficiary and you can change your beneficiary at any time.

Should I choose term life or whole life insurance?

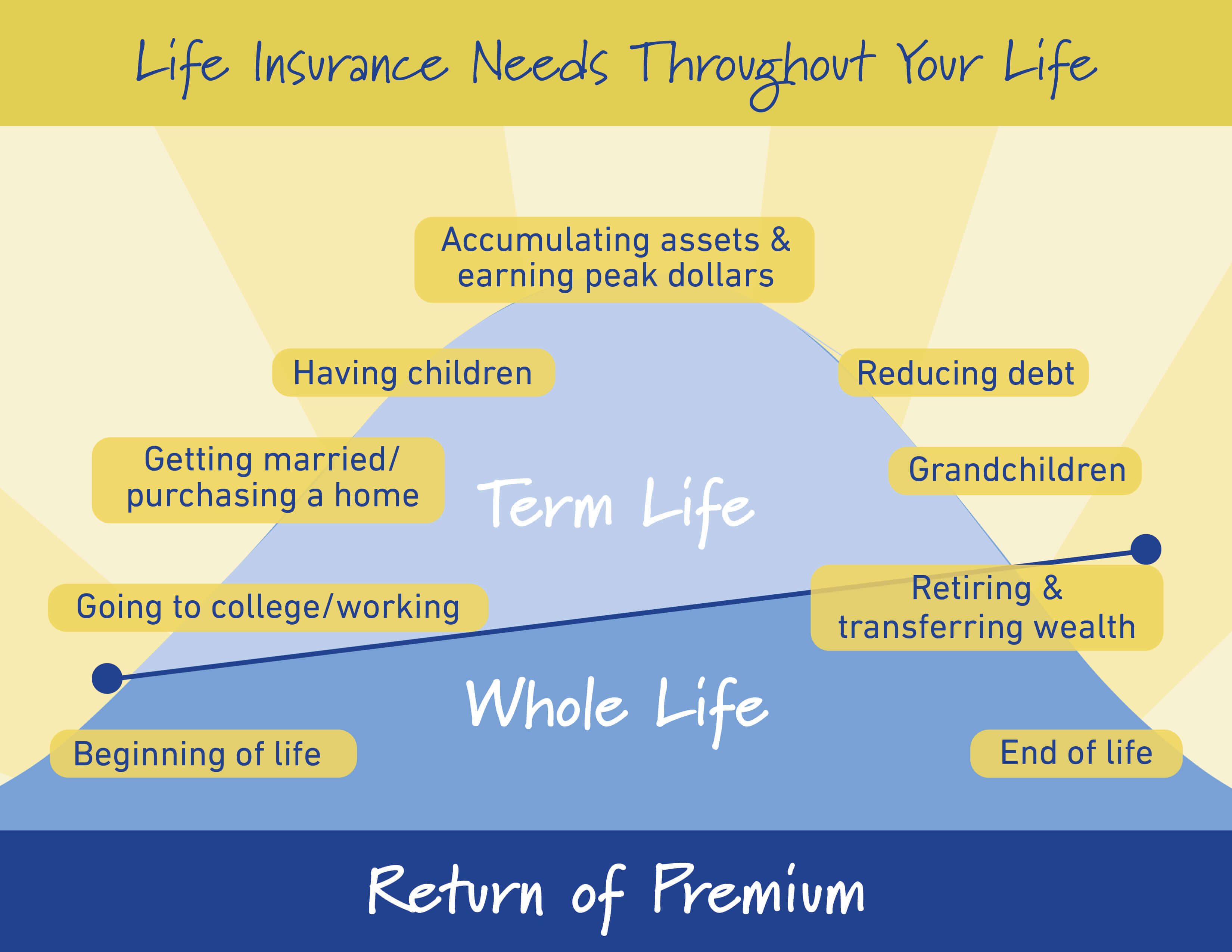

When choosing between a term life or whole life insurance policy, you must take a few things into consideration. Term life insurance only protects you for a specific number of years based on your policy. A whole life insurance policy provides the insured with lifelong protection.

The graphic below illustrates the life insurance needs you have throughout different stages of your life.

Can I buy multiple policies at once?

You can purchase more than one policy at a time. Which means you can have a term life insurance policy and a whole life insurance policy at the same time. This goes for return of premium life insurance, as well. Again, individuals have differing needs and wants when it comes to coverage and peace of mind.

Purchasing more than one life insurance policy may help you financially in the long run. It is important to research your options and speak with a professional insurance agent when shopping and purchasing life insurance coverage.

Life insurance is not required by law, but it is highly recommended for many reasons. Although, the last thing you may be thinking about when graduating college or getting engaged is purchasing a life insurance policy, it may be the best decision you make for your future and that of your loved ones.

Inside Story is for educational and informational purposes only. Inside Story is compiled from various sources, which may or may not be affiliated with our family of companies, and may include the assistance of artificial intelligence. While we strive to provide accurate and reliable content, we make no warranties or guarantees about its completeness, accuracy, or reliability, and are not responsible for the content of any third-party sources or websites referenced herein. The inclusion of any content does not establish a business relationship or constitute our endorsement, approval, or recommendation of any third party. Testimonials and examples provided are for illustrative purposes only and do not guarantee future or similar results or outcomes, and may not consider individual circumstances, goals, needs, or objectives. Inside Story does not provide legal, tax, or accounting advice. For individual guidance, please consult a qualified professional in the appropriate field.

Coverages subject to policy terms, conditions, and exclusions. Subject to underwriting review and approval.